Delving into the realm of Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, this introductory passage aims to intrigue and inform readers with a blend of informative insights and engaging language.

Following up with a detailed explanation of the topic to provide a solid foundation for understanding.

Auto Policy Quotes vs Full Coverage

Auto insurance is a necessity for drivers, providing financial protection in case of accidents or other unforeseen events on the road. When it comes to auto policy quotes versus full coverage, there are key differences that drivers should be aware of to make informed decisions about their insurance needs.

Auto Policy Quotes

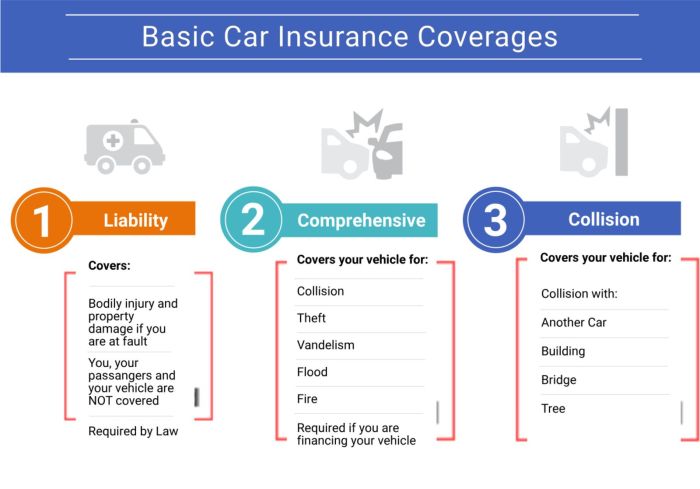

Auto policy quotes typically refer to the basic coverage required by law in most states. This type of policy usually includes:

- Liability coverage for bodily injury and property damage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP) or medical payments coverage

Full Coverage

On the other hand, full coverage goes beyond the minimum requirements and offers more comprehensive protection. Full coverage may include:

- Collision coverage for damage to your vehicle in an accident

- Comprehensive coverage for non-collision incidents like theft, vandalism, or natural disasters

- Rental car reimbursement and roadside assistance

Factors that influence the cost disparity between auto policy quotes and full coverage include:

- The level of coverage and types of add-ons included in the policy

- The driver's age, driving record, and location

- The make and model of the insured vehicle

- The deductible amount chosen by the policyholder

Coverage Types

When it comes to auto insurance, understanding the different types of coverage available is crucial in selecting the right policy for your needs. Let's delve into the various coverage types included in auto policy quotes and compare them with what is provided in full coverage to give you a better understanding of the protection and benefits offered to policyholders.

Liability Coverage

- Liability coverage is a standard component of auto policy quotes and full coverage.

- It provides protection in case you are at fault in an accident and covers the other party's medical expenses and property damage.

- Higher liability limits offer greater protection but may come at a higher premium.

Collision Coverage

- Collision coverage is typically included in full coverage but may be optional in auto policy quotes.

- It helps pay for repairs to your own vehicle in the event of a collision, regardless of fault.

- Choosing collision coverage can provide added peace of mind but will increase your insurance costs.

Comprehensive Coverage

- Comprehensive coverage is commonly part of full coverage and may be an optional add-on in auto policy quotes.

- It covers damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- While comprehensive coverage offers extensive protection, it can also raise your insurance premiums.

Uninsured/Underinsured Motorist Coverage

- This coverage is often included in full coverage policies but may be optional in auto policy quotes.

- It safeguards you in case you are in an accident with a driver who lacks insurance or sufficient coverage.

- Having this coverage ensures you are protected even when the other party is unable to cover your expenses.

Cost Comparison

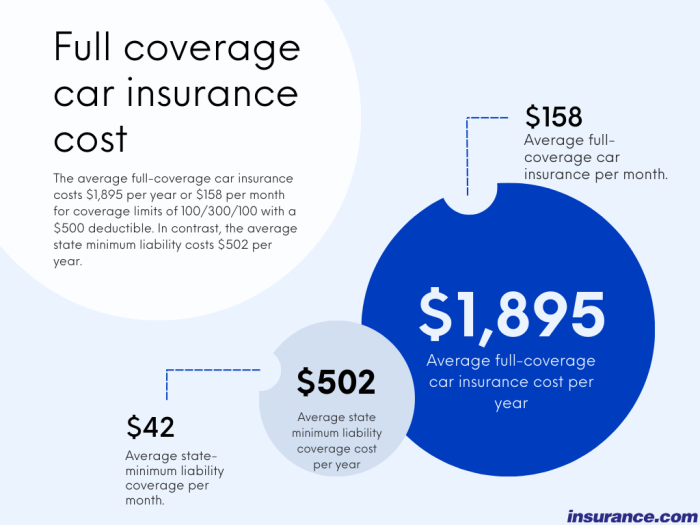

When it comes to comparing the costs of auto policy quotes and full coverage options, there are several key factors that contribute to the pricing variations between the two types of coverage. Understanding these factors can help individuals make informed decisions about which type of coverage is most cost-effective for their specific needs.

Factors Contributing to Pricing Variations

- Level of Coverage: Auto policy quotes typically offer less coverage than full coverage options, which can result in lower premiums. Full coverage, on the other hand, provides comprehensive protection for the insured vehicle and typically comes with a higher price tag.

- Deductibles: The amount of deductible chosen by the policyholder can significantly impact the cost of both auto policy quotes and full coverage. Higher deductibles usually lead to lower premiums, while lower deductibles result in higher premiums.

- Vehicle Value: The value of the insured vehicle plays a crucial role in determining the cost of coverage. Newer, more expensive vehicles generally require higher premiums for full coverage compared to older, less valuable vehicles that may only need basic auto policy quotes.

- Driving Record: A clean driving record can lead to lower premiums for both auto policy quotes and full coverage, as it indicates a lower risk of accidents and claims. On the other hand, a history of accidents or traffic violations can result in higher premiums for both types of coverage.

Evaluating Cost-Effectiveness

- Assess Your Needs: Consider the level of coverage you require based on factors such as the value of your vehicle, your driving habits, and your budget. If you have an older vehicle with a low market value, auto policy quotes may be a more cost-effective option.

- Compare Quotes: Obtain quotes from multiple insurance providers for both auto policy quotes and full coverage to compare costs. Make sure to evaluate the coverage limits, deductibles, and any additional benefits offered by each policy to determine the best value for your money.

- Review Discounts: Inquire about discounts that may be available for factors such as safe driving, bundling policies, or installing safety features in your vehicle. These discounts can help lower the overall cost of coverage, making full coverage more affordable in some cases.

Customization and Flexibility

When it comes to auto insurance, customization and flexibility are key factors that policyholders consider to tailor their coverage to fit their specific needs. Let's explore how auto policy quotes compare to full coverage in terms of customization options.

Level of Customization in Auto Policy Quotes

- Auto policy quotes typically offer a high level of customization, allowing policyholders to choose specific coverage limits, deductibles, and additional features based on their preferences.

- Policyholders can adjust their coverage to include options such as roadside assistance, rental car reimbursement, and gap insurance to better suit their individual needs.

- By customizing their auto policy quotes, individuals can create a personalized insurance plan that meets their budget constraints and provides adequate coverage for their vehicles.

Level of Customization in Full Coverage

- Full coverage insurance, on the other hand, generally offers less flexibility in terms of customization compared to auto policy quotes.

- While full coverage includes comprehensive and collision coverage, policyholders may have limited options to adjust specific coverage limits or add-ons beyond the standard package.

- Policyholders who opt for full coverage may have less control over tailoring their insurance to meet their unique needs compared to those who choose auto policy quotes.

It's important for policyholders to carefully consider their coverage needs and weigh the pros and cons of customization options when choosing between auto policy quotes and full coverage.

Final Conclusion

Concluding our discussion on Auto Policy Quotes vs Full Coverage: What’s the Real Difference?, this final paragraph encapsulates the main points in a compelling manner, leaving readers with a lasting impression.

FAQ

What are the key differences between auto policy quotes and full coverage?

Auto policy quotes typically focus on providing basic coverage, while full coverage includes comprehensive protection for various scenarios.

How do coverage types impact the overall protection for policyholders?

The coverage types determine the extent of protection and benefits that policyholders receive in different situations.

What factors contribute to the pricing variations between auto policy quotes and full coverage?

Factors such as the level of coverage, type of vehicle, driving history, and location can influence the cost differences between auto policy quotes and full coverage.

Is there flexibility in customizing auto policy quotes compared to full coverage?

Auto policy quotes may offer less flexibility compared to full coverage, as full coverage allows for more customization options to tailor coverage to specific needs.